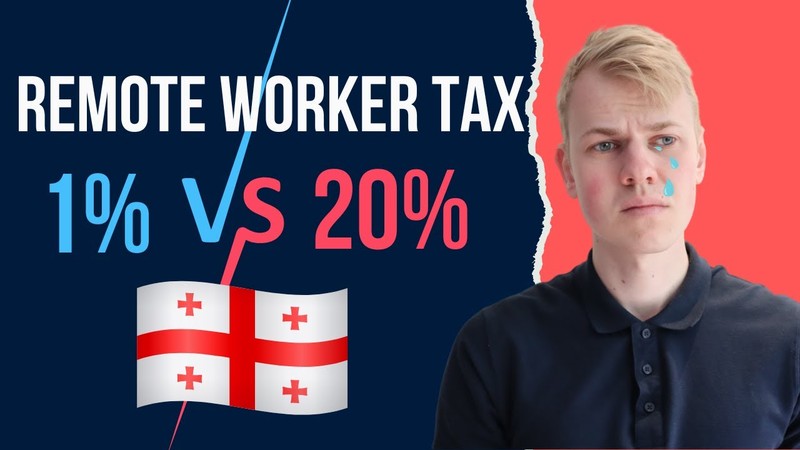

1% Tax on Remote Work in Tbilisi, Georgia. Is it True?

August 22, 2022

2 min read

You can pay only one percent tax in Georgia as an individual entrepreneur. It is a simple structure where you pay tax on turnover rather than profit, and you can not exempt expanses. It has a limit of 500.000 GEL which is roughly 180 thousand dollars. And if you made more for two consecutive years, the government will take away your individual entrepreneur status.

For remote workers living in a high-tax country like the US, France, or Spain, it's an opportunity to come to Georgia and save a lot of money on taxes. Yet, there is a caveat. This structure is for freelancers, and when you receive the same amount of money from the same entity, the government might decide to investigate you. And if they decide you are an employee and not a contractor, they can make you pay taxes for the last three years together with fines.

The law is a bit obscure, and we don't know how the government will decide if you are a service provider or an employee. But some things will make you look more like an employee. If your contracts include clauses on bonuses, benefits, non-compete, paid leave, medical insurance, vacation policy, or defined work hours, it is a red flag that a relationship looks more like an employee-employer. Also, if your name is on the client's website as an employee, or they are your only client, it's not good.

Another option is to open an LLC, which leads to 20% tax, but it has an Estonian model, where you only pay tax when you take money from the company. Yet 20% and 1% is a huge difference. That's all! Do you know tax-friendly countries for remote workers? Let me know, and stay productive!